Does Homeowners Insurance Cover Flood Damage in Washington?

Many homeowners are surprised to learn that insurance cover flood damage in Washington only under very specific conditions, depending on how water enters the home.

After recent storms and flooding across Western Washington, many homeowners are asking the same question: does homeowners insurance cover flood damage in Washington? The answer depends on how the water entered the home, not just how much damage it caused.

Understanding the difference between flood damage and water damage is critical before filing a claim or starting repairs. In many cases, homeowners assume they are covered — only to find out later that their policy excludes certain types of flooding.

According to the Federal Emergency Management Agency (FEMA), standard homeowners insurance policies do not cover flood damage caused by rising groundwater or surface water.

Flood Damage vs Water Damage: How Insurance Defines the Difference

To understand insurance coverage, it’s important to know how insurers define flood damage versus water damage. While homeowners often use these terms interchangeably, insurance policies treat them very differently. Coverage decisions are based on the source of the water, not the amount of damage it causes.

What insurance considers flood damage

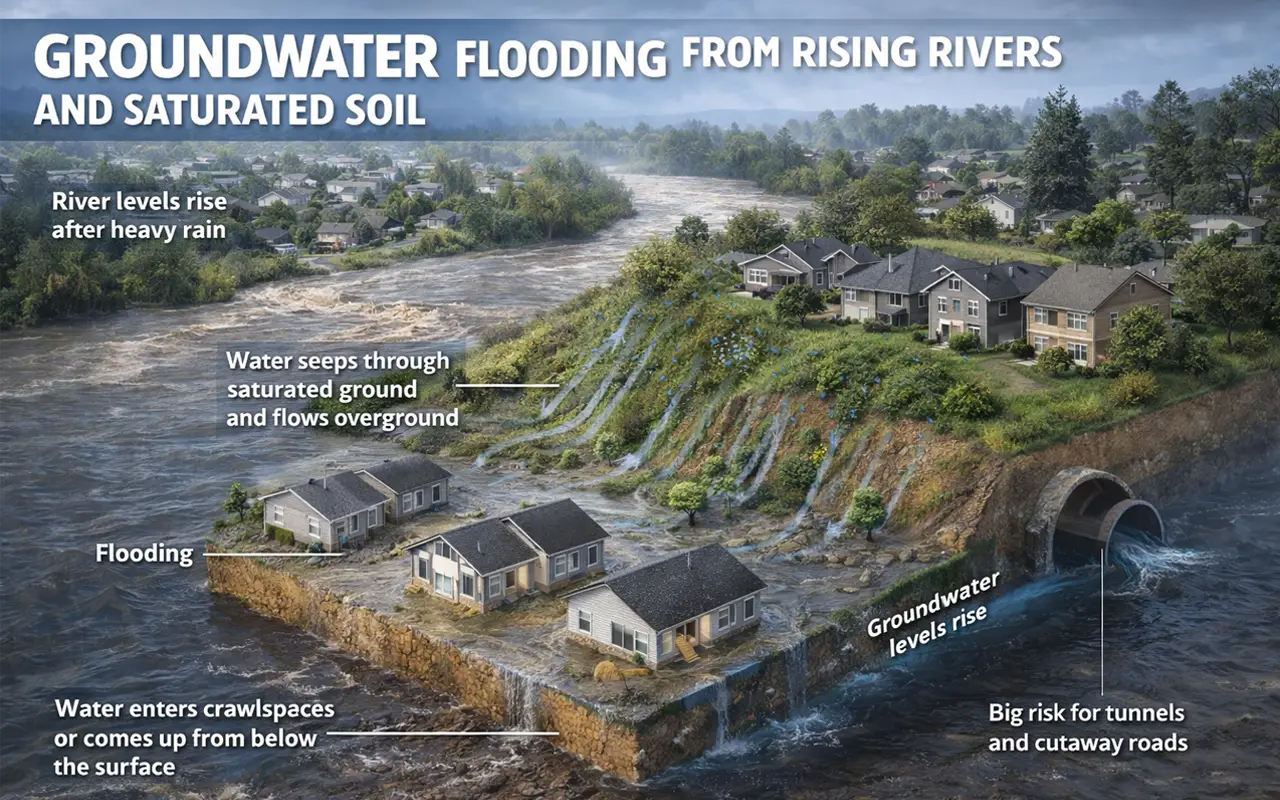

Flood damage is generally defined as water coming from outside the home and affecting the property at ground level or below. This typically includes water from overflowing rivers, surface runoff after heavy rainfall, rising groundwater, or saturated soil pushing water into a crawlspace or basement.

Under most standard homeowners policies, flood damage is excluded. This exclusion applies even if flooding happens quickly or affects only one home. In insurance terms, flooding does not require a named river or large body of water. Water moving across land and entering the structure can meet the definition.

What insurance considers water damage

Water damage, by contrast, usually refers to water that originates from inside the home or from a specific, sudden event. Examples include a burst pipe, a failed water heater, an appliance leak, or water entering through a roof opening caused by storm damage.

These events may be covered under a standard homeowners policy because they are considered accidental and unintended. However, coverage still depends on policy language, maintenance history, and whether the damage was addressed promptly.

Why this distinction matters

This distinction explains why two homes with similar damage may receive different insurance outcomes. A flooded crawlspace caused by rising groundwater is treated differently than water damage caused by a plumbing failure, even if the repairs look the same.

Understanding how insurers classify water intrusion helps homeowners set realistic expectations before filing a claim or beginning repairs.

Does Insurance Cover Flood Damage in Washington?

Rising rivers can push groundwater upward, causing water to enter crawlspaces and foundations — even for homes located uphill.

Concerned About Hidden Flooding?

What Homeowners Insurance Usually Covers

While flooding is commonly excluded, homeowners insurance does cover certain types of water-related damage when the source is sudden and accidental. Coverage depends on how the water entered the home and whether the event was considered preventable through routine maintenance.

Most standard homeowners policies in Washington may provide coverage when water damage originates from inside the home or from a specific, identifiable failure. These situations are typically viewed as unexpected and outside the homeowner’s control.

Examples of water damage that may be covered

- Sudden pipe bursts inside walls or ceilings

- Water heater or washing machine failures

- Dishwasher or refrigerator supply line leaks

- Roof leaks caused by storm damage

In these cases, insurance may cover the cost of repairing damaged materials such as drywall, flooring, and insulation. Coverage decisions often depend on how quickly the issue was addressed and whether there were signs of long-term neglect.

It’s also important to note that coverage usually applies to the resulting damage, not the failed component itself. For example, insurance may cover water-damaged flooring caused by a burst pipe, but not the cost of replacing the pipe if it failed due to age or wear.

Because policy language varies, homeowners are encouraged to review their specific coverage and exclusions before assuming a claim will be approved.

What Homeowners Insurance Usually Does NOT Cover

Understanding exclusions is just as important as knowing what is covered. In Washington, many homeowners are surprised to learn that significant water-related damage may fall outside their homeowners insurance policy, even when the damage is extensive.

Most standard policies exclude damage caused by flooding, which insurers define as water originating outside the home and entering at or below ground level. This exclusion applies regardless of whether flooding was caused by heavy rain, river overflow, or saturated soil.

Common water-related exclusions

- River or creek overflow affecting the home

- Groundwater seepage through foundations or crawlspaces

- Surface water entering through doors, vents, or low openings

- Crawlspace flooding caused by prolonged soil saturation

These exclusions exist because flood-related events are considered widespread and unpredictable, which is why separate flood insurance policies are typically required for coverage. Homeowners insurance is designed to handle isolated incidents, not large-scale water intrusion from the environment.

Another common exclusion involves gradual or repeated water exposure. If damage occurs slowly over time due to poor drainage, long-term moisture, or deferred maintenance, insurers may deny coverage even if water damage is present.

Because exclusions are often buried deep in policy language, homeowners sometimes assume they are covered until a claim is reviewed. This is why understanding policy limitations before or immediately after flooding is critical.

Have You Checked Your Crawlspace?

Standard homeowners insurance typically covers sudden internal water damage, but flooding from rivers, groundwater, or surface water usually requires a separate flood insurance policy.

| Water Damage Scenario | Standard Homeowners Insurance | Flood Insurance Required |

|---|---|---|

| Burst pipe or appliance failure | ✔ Covered | ✖ Not required |

| Rain entering through storm-damaged roof | ✔ Covered | ✖ Not required |

| Sewer or drain backup | ⚠ Only with endorsement | ✖ Not a replacement |

| Groundwater entering crawlspace or basement | ✖ Not covered | ✔ Required |

| River overflow or surface water flooding | ✖ Not covered | ✔ Required |

| Flooding after prolonged heavy rain | ✖ Not covered | ✔ Required |

Flooding Scenarios in Washington: Different Points of View

Flooding in Washington often looks different from large-scale disasters seen in other parts of the country. Instead of widespread river flooding alone, many homeowners experience water intrusion caused by heavy rainfall, saturated soil, poor drainage, or rising groundwater around the foundation.

From the homeowner’s perspective

Homeowners frequently view any unwanted water inside the home as flood damage, especially when it affects crawlspaces, basements, or lower floors. When water enters after days of rain, it can feel sudden and unexpected, even if the source is groundwater or surface runoff.

This is where confusion often starts. Homeowners may believe damage should be covered because there was no overflowing river nearby or because the water appeared during a single storm event.

From the insurance company’s perspective

Insurance companies focus on classification, not impact. If water originated from outside the structure and entered through the ground or foundation, it is typically classified as flooding. Under most policies, this places the damage outside standard homeowners insurance coverage.

This is why flood damage insurance Washington policies are usually separate from standard homeowners insurance. Insurers separate environmental water risks from internal plumbing failures to limit exposure during widespread weather events.

From the contractor’s perspective

From a repair standpoint, the source of water matters less than its effect on materials. Crawlspace flooding, wet insulation, and moisture trapped in framing require the same careful drying and repair process regardless of how insurance categorizes the event.

Contractors often see situations where repairs are necessary even though insurance coverage is limited or unavailable. This makes early assessment and moisture control especially important for homeowners deciding next steps.

What Homeowners Should Do Before and After Contacting Insurance

When water enters a home, the steps taken in the first few days can affect both insurance outcomes and the extent of long-term damage. Acting methodically helps homeowners protect their property while avoiding common mistakes that can complicate claims or repairs.

Steps to take before contacting insurance

Before filing a claim, homeowners should document conditions as thoroughly as possible. This includes taking clear photos and videos of affected areas, water lines on walls, damaged materials, and any visible moisture in crawlspaces or basements.

It is also important to limit additional damage where it is safe to do so. Removing small personal items from wet areas and allowing airflow can help stabilize conditions without altering evidence of the original event.

Steps to take after contacting insurance

Once a claim is opened, homeowners should ask their insurer how the event will be classified. Asking whether the situation falls under homeowners insurance flood damage or another category helps clarify expectations early in the process.

Homeowners should also avoid sealing walls, reinstalling flooring, or closing crawlspace access until moisture levels are confirmed to be under control. Premature repairs can trap humidity and lead to future issues that may not be covered.

Understanding what documentation is required and how decisions are made allows homeowners to move forward with repairs confidently, regardless of coverage limitations.

Crawlspace Mold After Flooding?

Key Takeaways and Planning the Next Steps

Water-related damage can be stressful, especially when coverage questions arise after flooding. Understanding how policies are written helps homeowners make informed decisions without unnecessary delays or assumptions.

In Washington, the distinction between flood damage and water damage plays a central role in determining insurance outcomes. While some events may fall under insurance coverage after flooding, others require homeowners to address repairs independently or explore separate flood insurance options.

Regardless of coverage, moisture left unaddressed can continue affecting a home long after water recedes. Crawlspaces, lower walls, insulation, and framing should be evaluated carefully before repairs are finalized to avoid trapping moisture inside the structure.

Knowing how insurers classify events, documenting damage early, and understanding the typical repair process allows homeowners to move forward with clarity. Even when insurance coverage is limited, early evaluation can help reduce long-term repair risks and prevent avoidable damage.

Understanding when insurance cover flood damage in Washington can help homeowners avoid denied claims and unexpected repair costs after flooding.

If your home has experienced water intrusion and you are unsure how to proceed, a professional assessment can help identify hidden moisture and determine the safest next steps before permanent repairs begin.

Frequently Asked Questions

Leave A Comment